With the implementation of the Basel III frameworks, the status of Gold is anticipating massive changes. However, what are the consequences of the framework?

Elementum Metals: 31/03/2021

Basel III is a set of international regulatory rules based on bank capital adequacy, stress testing and general market liquidity. It aims to improve the 3 key features of regulation, supervision and risk management of banks. Basel III was agreed upon by members of the Basel committee in November 2010 and has been delayed numerous times, with its latest implementation expected to start on 1st January 2022.

The main reason for the creation of these rules was in response to the 2008 financial crisis and more specifically the poor management and financial regulation over banks in regard to subprime mortgage lending. In this article I will look at the main implications of these rules on clearing bullion banks and central banks, to deduce the overall impact on Gold.

Articles written by Kinesis Money1, FX Street2 and Financial Sense3 have an outlook that Basel III will be bullish for Gold. However, this may not be the case, as they are only looking at one small segment of the regulatory rules, in how it will affect central banks. Basel III will also have a significant impact on clearing banks, which will have the greater influence on the Gold market, as the majority of gold transactions occur via these banks in the London OTC market (on average 20 million ounces of gold is settled each day).

This article will examine the impact of Gold on central banks and clearing banks, as well as looking at realistic solutions that may be implemented by clearing members, along with the main possible consequences on the bullion market.

Basel III regulations now treat Gold held by central banks in their own vaults or on an allocated basis, as equivalent to cash (a low-risk asset). Since 1994 Gold was considered to be a Tier 3 asset with a 50% Risk Weighting Assessment (RWA). This meant that central banks could only apply 50% of their Gold reserves value onto their balance sheets.

Under Basel III, Gold would qualify as a Tier 1 asset (zero risk asset), for central banks, allowing for a 1:1 valuation ratio for Gold, which in turn will allow every central bank to revalue its physical reserves higher. Monetary Gold for central banks is now considered to be risk free!

What this should do is increase demand for physical Gold for central banks as it now has a favoured value status for bookkeeping purposes. There is evidence to support this as 2017 was the largest buying of Gold by central banks in 50 years (651.5 tons), which coincidently was the same year the announcement of Gold becoming a tier 1 asset under Basel III.4

The main clause of interest within the Basel III framework which is expected to have an impact on bank holdings of gold is the Net Stable Funding Ratio (NSFR) and how it impacts banks’ Required Stable Funding (RSF).

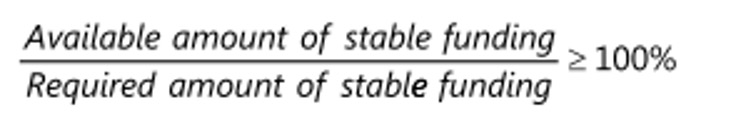

The NSFR is defined as the amount of available stable funding (ASF) relative to the amount of required stable funding (RSF). This ratio must equal at least 100% on an ongoing basis as illustrated below5:

The NSFR will have to be reported on a quarterly basis by banks, once full implementation has occurred on the 1st January 2022.

The ASF is the amount of stable funding the bank currently has. This includes the banks’ capital, preferred stock and liabilities with maturities all greater than a one-year time horizon

On the other hand, the RSF is the amount of funding which a bank needs to fund its assets and off-balance sheet commitments. In other words, it approximates the amount of an asset that could not be monetised through a sale or used as collateral during a liquidity stress scenario and therefore needs to be covered by a stable source of funding.

As mentioned in the section above the NSFR is the proportion of long-term assets funded by stable funding and is simply calculated by dividing the ASF by the RSF.

A key point to consider is that the NSFR fundamentally only recognizes funding with a maturity greater than one year. So, for example if an asset was being funded by cash, this cash must have been in possession by the bank for a minimum of one year.

In Summary: the NSFR will be used to oblige banks to finance long term assets with long term money (i.e., greater than one year) in order to avoid liquidity failures.

Specifically, for all precious metals, the NSFR ruling will require an 85% RSF to be held against the financing and clearing of precious metals transactions. This is a major increase from its pre-Basel III level of 0%.

This means that regulators are now deeming Gold to be an illiquid asset, that is riskier to hold compared to exchange traded equities (which have a RSF of 50%) and as risky as all other equities (RSF of 85%).

This example will look at the implications of NSFR and RSF from the clearing banks perspective. As mentioned, due to the ruling, 85% of the notional value of the physical inventory of precious metals, that the bank owns on their balance sheet must now be covered by collateralization with a time horizon greater than a year. In reality, this collateral will be cash as it has a RSF of 0%.

Let’s consider a hypothetical clearing bank that has unallocated gold holdings of $5bn and that bank holds 50% of the unallocated balance in physical gold i.e., a notional value of $2.5bn. As a result of Basel III and NSFR this bank must have 85% RSF. This means that for any metal inventory owned, the bank must now provide 85% collateralization in cash held greater than a year to cover their liability. So therefore, the bank will be forced to source (most likely through borrowing) $2.125 billion of funds to meet the 85% RSF requirement. Therefore, Basel III is going to be highly costly to the clearing banks as it destroys their previous bullion business model.

To illustrate these higher costs, consider this example: Let’s say, hypothetically that the clearing bank was charging its direct clients 10 basis points to hold gold on an unallocated basis. Now due to NSFR they will incur costs of for example, 100 basis points, just to borrow sufficient cash to cover RSF ie. the banks would effectively be paying for the privilege of running a clearing business.

Clearly, from a clearing banks perspective the initial response would be to pass these higher prices to their clients. This could cause costs to proportionally shift upwards across the entire supply chain. This would not be an ideal solution as it could hinder demand as economic agents leave the market in response to adverse prices. However, there may be a way around this:

Clearing members could solve their RSF problem through the allocation of their precious metals. In our example, let’s assume the clearing bank has 4 customers holding the pool of the $5bn unallocated gold. The bank can allocate gold (bars) from its balance sheet to each of the 4 customers. By converting the clients account from unallocated to allocated, the clearing bank can eliminate the impact of NSFR on its gold business as it will no longer hold gold on its balance sheet. This of course benefits the clearing banks, but still may increase costs for gold bullion businesses, as they are now required to hold their gold on an allocated basis, which is more expensive than holding on an unallocated basis.

The London Bullion Market Association (LBMA) want precious metals to be exempt from NSFR, as they claim it will disrupt bullion clearing in London, which handles $25 billion gold transactions a day. They believe the classification of Gold in Basel III is wrong, as the setting of an RSF of 85% (indicating Gold is illiquid) was made at a time where data involving the liquidity of Gold was scarce. Hence, they have performed their own research to prove that gold is in fact a liquid, stable asset. In their liquidity analysis they found that gold had an illiquidity ratio of 0.000018. Comparing this to the European Banking Authority (EBA) measure of corporate bonds and government bonds of 0.188 and 0.059 respectively, which in turn have a RSF factor of 15% and 0%, proving that Gold is very liquid. The closer this ratio is to zero, the more liquidity present in the market, therefore LBMA Chief Executive Ruth Crowell said this shows strong evidence that Gold is a “highly liquid asset”.6

Furthermore, in response to claims that Gold isn’t liquid during times of market stress, on their official website, the LBMA presents figures of March 2020 where daily trade volumes for Gold reached almost $100bn during a period when risky assets came under considerable pressure and £125 billion was wiped off the FTSE 100 on a single day.

The EBA will evaluate these appeals on whether precious metals will be covered, with the implementation being delayed until the 1st Jan 2022.

The LBMA’s general counsel has been quoted as saying that they are hoping for a reduction of the RSF factor from 85% to 50 percent, but ultimately their aim is to get an exemption.

A variety of consequences to the Gold industry could occur as a result of the Basel III regulatory rules being implemented. This section considers and analyses the main responses:

No Consequences: if the NSFR rules are successfully appealed and overturned by the EBA, however this is unlikely to happen.

Foreclosure of bullion banks: Their precious metals business model will no longer become attractive due to RSF. E.g., After 23 years of operation, Nova Scotiabank are shutting down their clearing businesses, with a potential factor being these proposed changes of Basel III which were originally proposed in 2009.

Increased costs: Remaining clearing banks will be forced to increase costs revolving around financing and clearing and settlement, in order to maintain adequate margins.

Chain effect: Shocks could ripple throughout the entire supply chain, with costs rising for the miners, refiners and mints.

Mitigation via Allocation: The actual effects of Basel III may be reduced from a clearing banks perspective due to the allocation process described earlier but this could still lead to greater costs for the clearing banks clients as mentioned earlier.

Many Economic commentators have been claiming that under Basel III regulations Gold will become bullish. However, what they are doing is only considering the rules from a central bank’s perspective. Of course, what really will have the major impact is how these rules affect the current clearing banks, as the majority of the Gold sector goes through these institutions, with on average 20 million ounces of Gold being cleared daily in the London OTC market. Central banks purchasing Gold reserves alone, will not have a significant impact on Gold prices, it will be the London OTC market. As discussed, the major impact of Basel III will be reduced liquidity, due to lack of market makers and bullion banks and supply chain shocks through higher costs, eroding profits.

By Jay Kumar - NTree International

https://www.fxstreet.com/analysis/what-will-basel-iii-rules-mean-for-the-gold-price-202012181719

https://www.lbma.org.uk/articles/net-stable-funding-ratio-update