Is Tsingshan's solution for the nickel supply pinch worth the environmental implications?

Elementum Metals: 17/05/2021

By now, we are all well aware of the big players in the Electric Vehicle revolution: Tesla, NIO, and even old-economy Volkswagen have become synonymous with the EV sector in less than a decade. As more electric plug-in chargers appear out of thin air on every other street corner in the UK and mainland Europe, it is predicted that EV sales will grow to a quarter of the automotive market by 2030 and control a jaw-dropping 81.5% of the market by 2050.1

Whilst the boom in EVs is in response to growing concerns of unsustainable carbon emissions, attention has started to focus on the sustainability of the constituent components of the vehicles. Take, for instance, the Lithium-ion battery which is used by most electric car companies. In 2020, the Li-ion battery market was $34.2 billion - and is forecasted to grow four times larger by 2027, equivalent to a CAGR of 18%.2 Interestingly, the name Li-ion is a bit of a misnomer; these battery types actually contain up to 80% nickel, as this is the main metal used in cathodes. Consequently, Wood Mackenzie expects nickel demand to grow from 128,000 tonnes in 2019 to 1.23 million tonnes by 2040. When coupled with geological mining constraints, this means that the industry would face an annual deficit of 60,000 tonnes until at least 2027.3

However, not all nickel mined is used for EV batteries or traded on the London Metal Exchange (LME). Mined nickel can be split into two broad categories: low and high-grade primary nickel. The secondary nickel market, on the other hand, is sourced from the recycling of nickel containing materials such as stainless steel. To focus on the primary nickel sector, low-grade primary nickel (Class II) accounts for roughly 45% of all nickel mined, while high-grade nickel (Class I) accounts for the other 55%.4 Class II nickel, such as nickel pig iron (NPI) or iron-nickel actually contains a relatively small amount of nickel - from 8-16% and 15-55% respectively.5

Class I nickel, on the other hand, contains at least 99.8% nickel. Battery technology exclusively uses Class I nickel as higher nickel content allows for higher energy densities and dissolvability.6 Only Class I nickel is traded on the LME due to the high purity standard of the mined metal. This LME exchange-traded nickel, is Class I nickel that satisfies specific delivery standards (this accounts for less than 25% of total finished nickel supply).

The expected nickel shortage had been propping up the price and helping the metal’s return outpace those of its peers. From mid-July 2020 to the end of February 2021, LME Nickel had a return of almost 50%, whilst LME Gold in comparison returned almost -16% during the same period. However, the abnormal return above its metal counterparts was put to an end in the first week of March when the price sank almost 20%, from almost $20,000/tonne to just over $16,100.

Tsingshan Holding Group, one of the world’s largest and most successful stainless-steel producers, sent shockwaves through the industry by proclaiming it had signed deals with Huayou Cobalt and CNGR Advanced Material, to supply 60,000 and 40,000 tonnes respectively of nickel matte from 2022.7

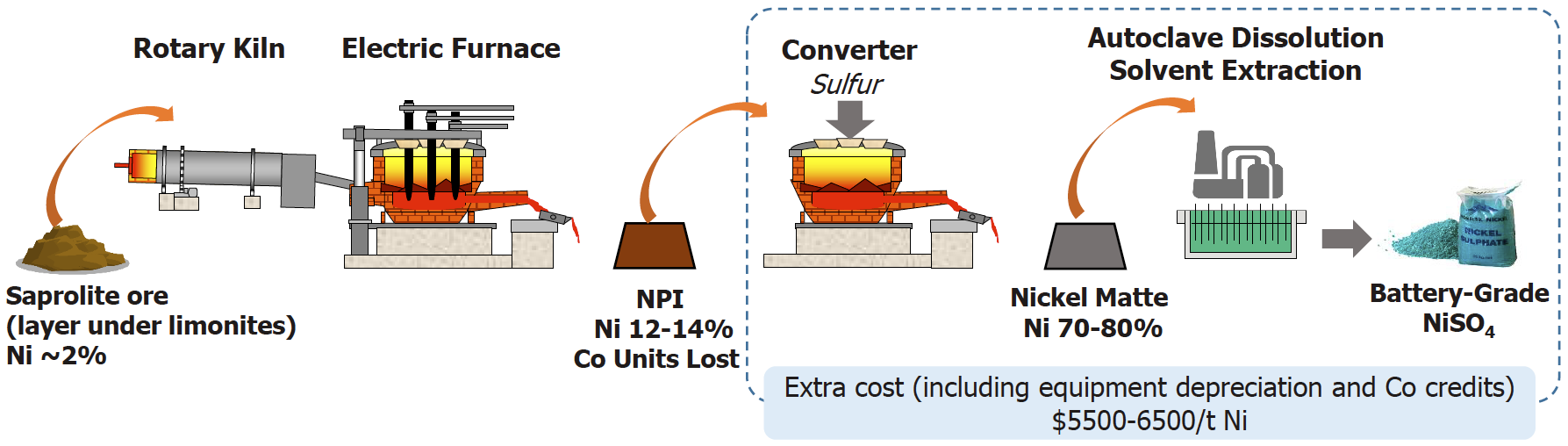

This announcement signaled the potential increase of feedstock in order to produce Class I nickel, raising the possibility that the estimated supply shortages could be avoided. Saprolite ore is refined and turned into NPI which is in turn refined into nickle matte and then further processed to make Class I nickel. Hence nickel matte is a crucial step in the refining chain of nickel used in EV batteries.

The bifurcation of the nickel value chain has been driving price differentials amongst different nickel products: fast growing NPI capacity, mainly from Indonesia, has been driving supply of Class II nickel. This dampens the price of Class II nickel while the shortage of Class I nickel needed for EV batteries has caused a huge premium versus both NPI and refined nickel. However, if the method announced by Tsingshan becomes widely applied to produce matte and then sulphates, we could see a price convergence of both classes (based on nickel content). Nevertheless, there is less clarity about production costs compared to traditional feedstock (such as briquettes) to produce sulphates. Research from Norilsk Nickel suggests that the extra cost of processing NPI to matte and then to battery grade nickel sulphate (NiSO4) will be about $5,500-$6,500/tonne of nickel (see diagram above).

The main challenge for nickel sulphates is a lack of high-quality feedstock material such as intermediary nickel products – briquettes, and powders. Furthermore, there have also been worries about the viability of mass-produced sulphates via existing methods in order to meet future demand for the EV industry. Tsingshan’s announcement may have the potential to fix both of these challenges, but what does this mean for the market, and how does the market view this new plan?

The message to the market is that the premium within exchange-traded nickel should decrease dramatically due to this technical breakthrough, essentially flooding the notoriously undersupplied nickel sulphate market. The initial reaction, for now, seems to be that briquette (part of the exchange-traded Class I family) will become less critical to producing sulphate given the new way of producing feed stocks (nickel matte). It seems that until a new market equilibrium is found and Tsingshan physically delivers the matte as promised, exchange-traded nickel will continue to be under pressure.8

Whilst the news may have made battery makers and EV companies ecstatic (recall Elon Musk’s plea for mining companies to “please mine more nickel”), the key question is how sustainable the new feed stock will be, especially given that the whole raison d’etre of the EV industry is to reduce carbon emissions.

Unfortunately, when talking about nickel mining, the environmental impact is never too far away; a 2009 study published in PLOS One concluded that nickel was the eighth worst metal in terms of the environmental impact of mining and processing.9 For instance, 39% of global nickel reserves are found in locations that are exposed to high or extreme biodiversity risks – and because nickel typically comes in thin ore deposits, these areas are often destroyed. Furthermore, one-third of nickel reserves are also in areas with high levels of water stress. Companies have been accused of polluting rivers, wells, and farmland, the effects of which have been exacerbated due to water scarcity in these mining areas.10

However, the world’s second biggest nickel miner, Norilsk Nickel, has recently vowed to invest $5.5 billion over the next 10 years to modernise equipment in order to utilise greener technologies, clean up the environment, and support national parks. This also includes reducing emissions produced on the Kola peninsula by 85% by the end of 2021. Because nickel deposits are mainly found in low-grade ores, extracting the actual metal is an extremely energy intensive process: 13 kg of CO2 are produced per kg of nickel during primary ore extraction methods.11 Once past this stage, hydrometallurgical processes use Class I nickel sulphides to produce battery grade sulphate NiSO4. This process produces an additional 5-10 tonnes of carbon emissions per tonne of nickel. Tsingshan has added extra stepsto this traditional method. Although they have proven that the new technology could be financially viable, the environmental impact is questionable.

Whilst acknowledging the technical success of the new nickel extraction method, Morgan Stanley noted that this new process “is far from green”. By some estimates, they stated, this new process would produce 10 times the carbon emissions of current hydrometallurgical processes.12 Their concern focuses on the pyrometallurgical nature of the process of converting NPI to matte – specifically, the addition of sulphur in the converter (see figure above) will produce significant sulphur dioxide, while the intense heating of the matte will also produce further carbon emissions. In a recent podcast, S&P Global stated that this process would be the most carbon intensive mining process ever, contributing 50-70 tonnes of emissions per tonne of nickel mined in order to convert NPI to matte and then further into NiSO4.13

Even though Tsingshan’s news upended the nickel market at the start of March, commodity trader Trafigura Group may not be convinced that it will be a panacea for the predicted nickel shortage. The group, along with Musk’s Tesla Inc., signed a new deal in late March to enter the Goro nickel mine in New Caledonia after Vale SA was forced to shut it down in December due to violent protests.14 The deal shows that Trafigura and Tesla may not be on board with the environmental impact of Tsingshan’s proposition, as carmakers’ preferences for cleaner sources of cobalt and aluminium suggest they may follow a similar path with nickel.

The Goro nickel mine uses a process known as high-pressure acid leach (HPAL) technology to recover nickel and cobalt separately from each other from low-grade nickel-oxide laterite ores - the nickel that is recovered is Class I, battery grade nickel sulphate. Whilst this is not a new technology, high capital expenditure and environmental costs have caused it to lag behind current methods. For instance, the Goro mine capital expenditure surged from $1.5 to $4.5 billion while only operating at 70% of its full capacity. This caused Vale, who bought the mine in 2006, to sell its stake in 2017 as it incurred sequential yearly losses.15 However, with the increased nickel price and the rapidly growing EV revolution, nickel demand is unprecedented. While the environmental costs of HPAL are still very much a concern, Socrates Economou, Trafigura’s Head of Nickel and Cobalt Trading, states that high nickel prices are necessary in order to incentivise producers to invest in cleaner technologies that could see HPAL greatly reduce its carbon footprint. Perhaps, this means that Trafigura and Tesla will make this asset work as it has never done before. Economou stated that “All the pieces have come together now”.

While Trafigura and Tesla may believe that the new deal would be economically efficient, how does HPAL compare to the Tsingshan matte technology? Though not without caveats, HPAL would certainly be a better environmental alternative for producing battery-grade nickel from laterite ores, though it still would have a greater environmental impact than extraction from sulphides. Because most HPAL facilities are coal-fed, the process would emit about 15-30 tonnes of carbon per tonne of nickel, again raising questions about whether the net benefits of nickel mining for EVs outweigh the costs.16 Australia-based firm Clean Teq is currently aiming to use solar energy instead of coal for their Sunrise HPAL project which could drastically reduce the carbon footprint, although this has yet to be seen in practice.

All in all, the high level of pollution involved in processing NPI into matte is likely to be unpalatable in the US and Europe where car makers are already under extreme pressure to reduce the carbon footprint of EV production. China, which imported 3.4 million tonnes of nickel ore from Indonesia in 2020 (where Tsingshan Holding Group is based), has been the leader of the EV race for the past decade and could potentially be the country that benefits the most from this nickel matte production – however, the potential increase in the battery-grade nickel supply could have a knock-on effect for the rest of the nickel market, especially in the short term as we have seen during the past month.

Regardless of the above costs, for now China has picked HPAL as its choice technology to develop premium nickel supply from low-grade deposits. They are still ahead of the world in HPAL investment projects, especially in Indonesia, where Chinese companies are looking to process domestic Indonesian nickel given the export ban on nickel ore. In August 2020, GEM China signed a contract with PT Halmahera Persada Lygend (an HPAL plant on Obi Island) to supply between 74,400 and 178,560 mt, which delayed starting production until March 2021 due to the pandemic.17

For now, the announcement of new feedstock has caused the nickel price to sink 20% due to the anticipated dramatic increase in supply of battery-grade nickel. Even though this may fix the Class I nickel shortage in theory, the environmental impact of such a process may mean that batteries made from matte may not meet environmental standards, essentially quashing the viability of increased supply. In the long term, new HPAL facilities might displace the need for matte by producing battery-grade nickel that adheres to the necessary environmental standards. In the shorter term, on the other hand, if more NPI is converted to nickel matte and then further into Class I, we expect a shortage of NPI and a commensurate increase in price for Class II nickel.

By Daniel Stoianov

https://www.statista.com/statistics/1202364/ev-global-market-share/

https://resourceworld.com/worldwide-vehicle-electrification-to-drive-nickel-demand/

https://www.nornickel.com/investors/commodity-research/?fileID=39608#2020

https://think.ing.com/articles/nickel-the-re-marriage-in-class-1-and-class-2-markets

https://nickelinstitute.org/media/4809/lca-nickel-metal-final.pdf

https://open.spotify.com/episode/5YX9D8uWzwYf3Whb7p2Oco?si=qbGJI9nRR_C81pfL8JXaBA&nd=1

We recently recorded a webinar titled 'Perspectives on Uranium Demand and Supply'. You can view it here. Please use passcode ?3gDUblB