The growth of interest in clean energy investing has been dramatic over the past few years. The number of reports coming out of bodies such as the International Energy Agency provides clear evidence that major economies have embarked on a path away from fossil fuel use to increased use of renewable energy.

Elementum Metals: 21/07/2021

The growth of interest in clean energy investing has been dramatic over the past few years. The number of reports coming out of bodies such as the International Energy Agency provides clear evidence that major economies have embarked on a path away from fossil fuel use to increased use of renewable energy.

In the equity space, there have been some clear winners and losers in terms of investor money flows. Companies focused on renewable energy have attracted significant interest. On the other hand, those in the fossil fuel camp have seen some major investors pull out while in some cases also facing pressure from remaining shareholders to reduce carbon emissions and make a meaningful shift towards renewables.

The challenge for investors looking to make an allocation to energy transition stocks is to identify winners and losers in this unfolding journey, as in the case of Betamax versus VHS the best technologies may not necessarily win. Reducing stock specific risk by investing in Exchange Traded Funds (ETFs) is a potential option and there is plenty of choice from clean energy through to battery technology and hydrogen ETFs. It pays to check the index constituents to check to what extent their activities match the name on the bonnet.

An alternative approach for investors to consider is diversification or reduction of equity exposure to the energy transition theme by investing directly in the commodities that are key to delivering clean energy. Whether a wind power company is a winner or loser, it will need to buy copper, similarly, in the race to win market share in the EV space, the manufacturers of battery packs will need to access nickel and other key materials.

The International Energy Agency in its May 2021 report, The Role of Critical Minerals in Clean Energy Transitions, projects significant growth in minerals demand in 2040 relative to 2020 levels. In a clean energy technology scenario where the Paris Agreement goals to limit global warming to well below 2 degrees Celsius, are met, their share of total demand rises to over 40% for copper and 60-70% for nickel and cobalt. In aggregate, it would imply a quadrupling of mineral requirements for clean energy technologies by 2040. EVs and battery storage would account for about half of the mineral demand growth from the clean energy sector. By weight, mineral demand in 2040 would be dominated by graphite, copper and nickel.

-IEAGraph.png)

Stated Policies Scenario: an indication of where the energy system is heading based on a sector-by-sector analysis of today’s policies and policy announcements

Sustainable Development Scenario: indicating what would be required in a trajectory consistent with meeting the Paris Agreement goals.1

A supply side response will be required in order to meet the projected increase in demand for copper and nickel. This will be far from straightforward as highlighted in the IEA report. In the case of copper, the quality of ore bodies is declining, which puts pressure on costs, emissions and waste production. In addition, mines in South America and Australia are subject to climate and water stress, which further complicate mining operations. Nickel requires battery-grade Class 1 supply, which is seen by analysts as largely dependent on the success of high-pressure acid leach (HPAL) projects. These projects are capital intensive and face emissions and tailings challenges, which is also the case for alternative Class 1 supply options such as the conversion of nickel pig iron to nickel matte. The high level of emissions was one of the principal concerns raised after China’s Tsingshan announced it was using this process.2

The question remains as to how fast the supply response will be. Most likely, there will be a lag in the response given the lead time to identify and develop mines as well as the inevitable delays in completing projects. CRU, for example, is looking at 5.9 million tonne long-term copper supply gap opening up from the mid-2020s, which, as highlighted in the quote by Trafigura’s Jeremy Weir could grow larger by 2030.3 With the scope for shortages, industrial consumers are moving to secure supplies. In the case of metals needed for electric vehicles, for example, Thomas Schmall, Volkswagen's board member in charge of technology, told Reuters in June 2021, “We're all in a race. It's about making the most affordable cells and you need scale to do that. Apart from cell manufacturing, which is a new area of business for us, we need to move into vertical integration more strongly, procuring and securing raw materials.”4

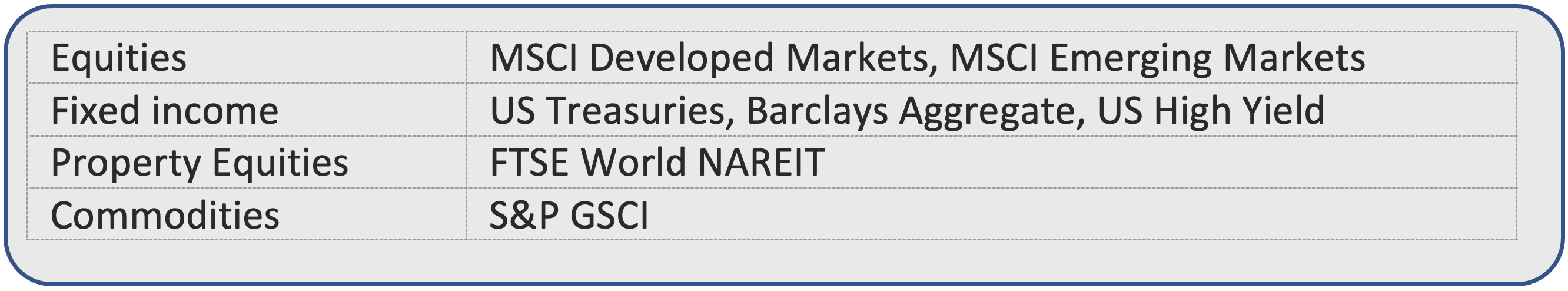

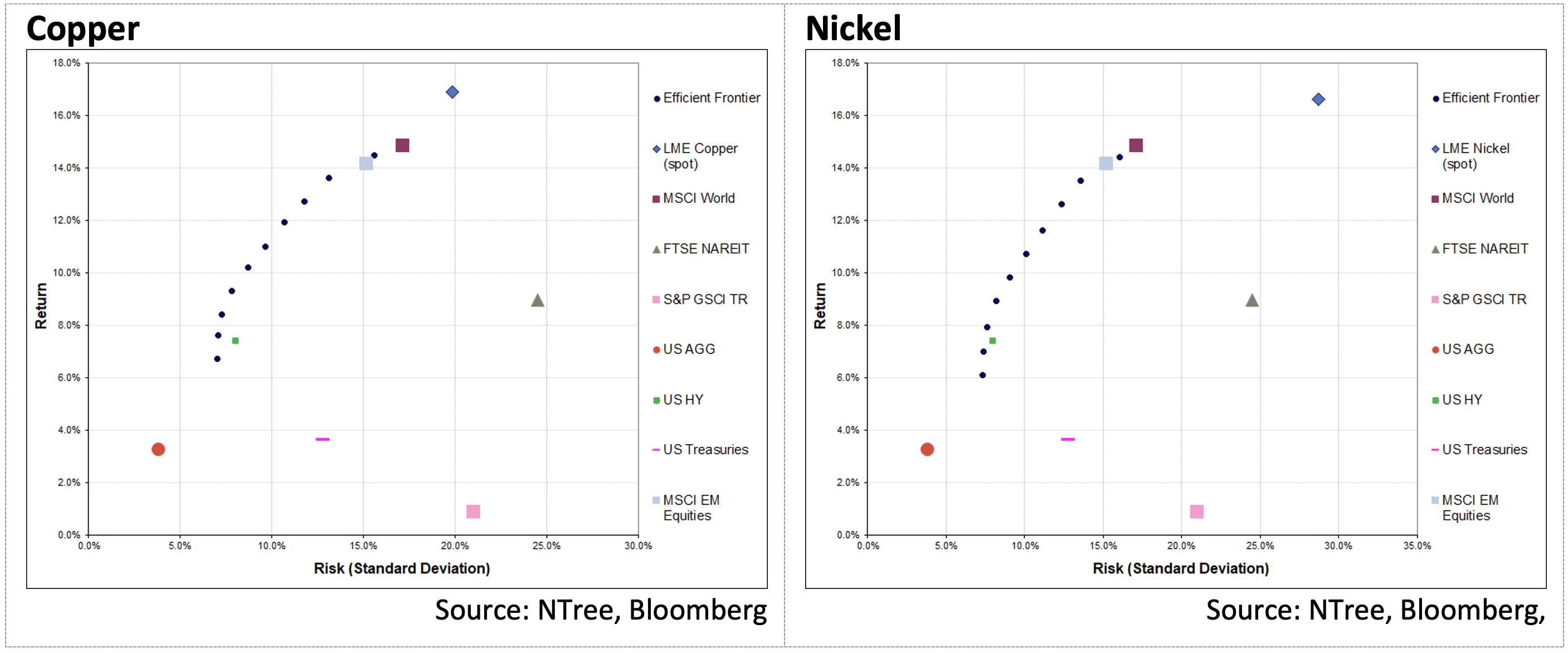

This may sound exciting, but from an investment point of view, a key question to consider is whether the inclusion of copper and nickel in a diversified portfolio can potentially add value? To provide an answer, the research team at NTree International, using a portfolio optimiser tool, looked at a multi-asset portfolio and then added individually Copper and Nickel to the mix. The benchmarks used in the simulation include:

Using a 5 year time frame, which reflects the time period over which interest in clean energy and electrification has started to build, exposure to the metals was found to be accretive in terms of improving risk-adjusted returns and positioning a multi-asset portfolio on the efficient frontier as illustrated below:

In the context of the benchmarks used, the S&P GSCI was found not to add value in terms of risk-adjusted returns. This should be seen in the context of the 5-year timeframe, a period during which, with the exception of the last 12 months, the prices of many commodities were relatively weak.

From an investor perspective, the portfolio optimiser analysis is helpful because it highlights the potential for nickel and copper to be part of a diversified portfolio. As with any potential investment and asset allocation decision, each investor needs to understand the potential risks involved and how an investment could serve to enhance overall portfolio performance.

An investment in commodities can provide portfolio diversification as it is a distinct asset class with a different risk profile to equities and fixed income. But with commodities, it can pay to be selective. The particular attraction of copper and nickel lies in the fact that they play a critical role in the transition to a clean energy economy, which implies significant incremental demand for these metals in the coming decade. This has not gone unnoticed by investors. Recent research from the Global Palladium Fund polling 150 European pension funds found that 49% were looking to overweight copper in the next 12 months.

1. https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

2. Tsingshan’s Nickel Plan, metal.digital, 17 May 2021

3. MAPPED: These 25 projects will set the copper price for decades, mining.com, 17 June 2021

4. Volkswagen seeks partners for battery materials race, Reuters, 15 June 2021

We recently recorded a webinar titled 'Perspectives on Uranium Demand and Supply'. You can view it here. Please use passcode ?3gDUblB