Rare earths are a group of 17 minerals, all metals, consisting of yttrium, the 15 lanthanide elements and scandium. Rare earth oxide compounds are widely used – although generally in small quantities – within everyday electronic devices such as computers, batteries, mobile phones, magnets and fluorescent bulbs.

Elementum Metals: 22/04/2021

Rare earths are a group of 17 minerals, all metals, consisting of yttrium, the 15 lanthanide elements and scandium. Rare earth oxide compounds are widely used – although generally in small quantities – within everyday electronic devices such as computers, batteries, mobile phones, magnets and fluorescent bulbs. They are used in larger quantities in electric motors and generators, hi-tech aeronautical equipment and sophisticated defence materiel. The largest, rare earth deposits are located in China, which therefore dominates production of these useful elements.

This group of 17 metals are historically known as rare earths as their deposits are sparsely distributed within the earth, so are termed ‘rare’; ‘earth’ is an old-fashioned term referring to the way they are extracted by dissolving with acid. Rare earths are not scarce, although their occurrence in small quantities makes economically viable extraction challenging. Rare earths have many similar geological properties, which often means they are located together in certain geographic deposits. The most abundant rare earth elements include cerium, yttrium, lanthanum and neodymium, which are about as common as nickel, zinc or lead. The scarcest are thulium and lutetium, although even these deposits are estimated to be 200 hundred times the size of gold1, perhaps illustrating how much of a misnomer the term ‘rare earth’ truly is.

The largest, rare earth deposits are in China, making up around 37% of global reserves, with other sizeable reserves to be found in Russia, North America and Australia.2 Around 80% of rare earth processing occurs in China, with small amounts carried out in Japan, Estonia and Malaysia.3

China’s dominance of production originates back to the 1980s and 1990s. Rare earth extraction and processing was regarded by most Western companies as marginally economically viable, made even less attractive due to high environmental costs associated with extraction and purification processes. China has long recognised the strategic importance of these minerals to its economy, and as such, has been committed to continued production, in particular as unique inputs into the manufacture of electronic products, the cornerstone of its economy in the late 20th century. In 1987 Deng Xiaoping commented ‘the Middle East has oil, China has rare earths’, providing a real sense of how the country’s leadership saw the potential to exploit their strategic importance.4

Rare earths are used in small quantities as oxide compounds for their unique electronic and magnetic properties within many electronics devices, such as computers, mobile phones, televisions, batteries and fluorescent bulbs. For example, iPhones use rare earths within speakers, cameras and taptic engines. However, by quantity, three-quarters of rare earth production is consumed by catalysts for chemical reactions, while ceramics, glass, lasers and surgical equipment are other important uses.5

Aside from these longstanding sources of demand, a rapidly emerging sector for rare earths is within magnets. An electric motor is essentially a coil of copper wire encircled with permanent magnets. The coil spins as the electric current emits a magnetic field which repels the opposing permanent magnets around it, thereby powering the motor.6 Rare earth magnets are either sourced from light minerals that make up 85% of the reserves of heavy minerals, the latter being better suited to use within Electric Vehicles (EVs). Samarium and neodymium are both used with magnets although the latter is most commonly used, diffused with dysprosium to provide a superior combination of power and weight, providing the high energy efficiency vitally important for EVs.7

By 2030, there will be an estimated 125 million EVs, rising to 900 million EVs by 2040.8 Around 90% of today’s EVs contain rare earth magnets, using between 2 - 5 kg of rare earths within motors, while batteries, transmission systems and braking systems use smaller quantities, totalling around 9kg, of which 95% is neodymium.9

Developments in EV technologies are forecast to reduce quantities of rare earths used, through discoveries such as Toyota’s development of magnet technology using significantly less neodymium.10 Conversely, while earlier Tesla models used small quantities of rare earths, the new Model 3 Long Range uses motor technology with neodymium magnets.11

Wind turbine electric generators also use permanent magnets; according to the EU, this was the case for nearly all the onshore turbines in Europe in 2018, and 76% of offshore wind turbines. Progress is being made developing alternative technologies, such as superconductor-based generators and hybrid drive generators which use smaller permanent magnets, reducing the amount of neodymium, praseodymium and dysprosium used by up to two thirds, however most replacements are less efficient.12

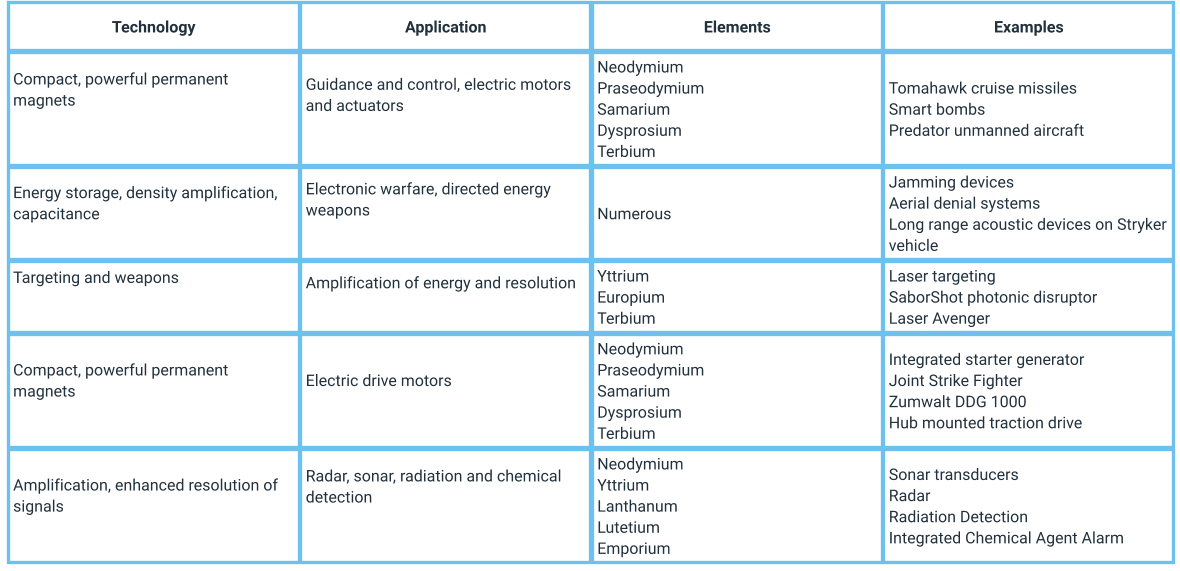

Rare earths are also extensively used within high tech military equipment for their specific electronic and magnetic characteristics; for example, lanthanum is used in night-vision goggles, samarium within precision guided missiles and neodymium in laser guidance systems. The F-35, the main jet fighter used by US forces also extensively used by NATO, uses an estimated 417kg per plane within its highly sophisticated electronics while each Virginia class submarine uses 4.2 tonnes.13

The Mountain Pass mine in the Mojave Desert California, first mined in the 1950s, was in fact the world’s primary source of rare earths, however the facility was closed in the 1990s as manufacturing moved East in the face of low-cost competition from China and concerns of environmental scarring.15

In 2010/11, prices of rare earths spiked when the Chinese government, then the source of 97% of global supply, announced an export ban, ostensibly due to environmental considerations limiting production quota increases, and in order to preserve supply for domestic manufacturing. This supply scares temporarily kick-started production outside the country, however the episode did little to change long term production trends, with China soon acceding to a World Trade Organisation ruling to lift the ban to recommence exports.16 The longer-term result was possibly as China had intended, further encouraging international electronic manufacturers to relocate operations to China, where reliable supplies of rare earths were assured.

The largest importers of rare earth oxide compounds are the US, which in 2020 imported US$110m worth of rare earths, and Japan.17 Concern about the strategic importance and security of supply taking into account the risk of potential price spikes such as seen in 2010/11, has compelled governments in recent years to work with miners to reactivate extraction and processing capabilities.

Rising trade tension has led the US government to support the Lynas Corporation, the largest, rare earth producer outside China, to construct a rare earth mining and refining facility in Texas to secure supplies for the country’s military. Round Top mountain in Texas is rich in rare earths and magnetic materials, holding the prospect US self-reliance through the annual production of 2,000 tons of magnets.18 In Australia, the government is promoting significant investment in extraction and processing by Northern Minerals developing a dysprosium plant in the Northern Territories, whilst also supporting Hastings Technology Metals in bringing online a neodymium and praseodymium facility in Western Australia.19

Former President Donald Trump’s suggestion at the height of US / China trade tension that the US might purchase Greenland, an autonomous region of Denmark, was at the time regarded by many Europeans as ludicrous; the idea does however illustrate the strategic value of Greenland’s estimated 38.5m tonnes of untapped rare earth reserves, a significant proportion of the world’s total of 120m tonnes.20

Estimated global demand for rare earths is increasing by 5% per year, although demand increases are particularly rapid in China, where growth in EVs achieve the country’s zero emissions pledge is well established.21 Demand is increasingly out of step with permitted increases in mining quotas of around 6% p.a.; domestic demand is now estimated to exceed supply by 30%, leading China to import from Myanmar and even the US.22

Rare earth mining can be ecologically harmful if not effectively regulated. In China, rare earths are commonly extracted either by removing topsoil, soil and rock to be separated from rare earth in leaching ponds using chemicals and acids; alternatively, water and chemicals are pumped into hillsides with spoil captured in leaching ponds. The leaching process creates ammonia and nitrogen by products, while lead and cadmium are released from the soil as by products. China’s Ministry of Industry and Information Technology estimates cleaning up pollution in Jiangxi Province in south east of the country will cost around US$5.5 billion.23 At present, a very small proportion of rare earth are recycled for reuse from magnets, batteries and fluorescent light bulbs, estimated to be only 1% of annual consumption as recycling is hampered by the design of consumer products not intended to be recycled and the very small quantities used.24

Rare earth minerals are increasingly important within high tech appliances and green technology, although some substitutes and alternative technologies are being identified. Its expected China will remain the primary source of raw minerals and processed oxide compounds despite domestic initiatives to limit the environmental impact and the development of new facilities in US and Australia. Rare earth supplies are expected to remain strategically important and potentially politically contentious.

Geology.com. https://geology.com/articles/rare-earth-elements/

British Geological Survey. https://www.bgs.ac.uk/news/rare-earth-elements-a-beginners-guide-from-the-bgs/n

U.S. Geological Survey, Mineral Commodity Summaries. https://pubs.usgs.gov/periodicals/mcs2021/mcs2021-rare-earths.pdf

Financial Times. https://www.ft.com/content/3cd18372-85e0-11e9-a028-86cea8523dc2

U.S. Geological Survey, Mineral Commodity Summaries. https://pubs.usgs.gov/periodicals/mcs2021/mcs2021-rare-earths.pdf

Bunting, Rare Earth Magnets in Electric Vehicle Motors. https://www.buntingeurope.com/rare-earth-magnets-in-electric-vehicle-motors/

Electronic Design. https://www.electronicdesign.com/technologies/analog/article/21805919/4-things-you-should-know-about-magnets-for-electric-vehicles

International Energy Agency. Global EV Outlook 2018 – Analysis - IEA Wood MacKenzie. https://www.woodmac.com/news/opinion/batteries-powering-the-fight-against-climate-change/

Electronic Design. https://www.electronicdesign.com/technologies/analog/article/21805919/4-things-you-should-know-about-magnets-for-electric-vehicles

Financial Times. https://www.ft.com/content/3cd18372-85e0-11e9-a028-86cea8523dc2

Reuters. https://www.reuters.com/article/us-metals-autos-neodymium-analysis-idUSKCN1GO28I

European Commission. https://ec.europa.eu/jrc/en/publication/eur-scientific-and-technical-research-reports/role-rare-earth-elements-wind-energy-and-electric-mobility

Financial Times. https://www.ft.com/content/d3ed83f4-19bc-4d16-b510-415749c032c1 + China Power. https://chinapower.csis.org/china-rare-earths/

Congressional Research Service https://fas.org/sgp/crs/natsec/R41744.pdf

Financial Times. https://www.ft.com/content/b13a3c4e-e80b-4a5c-aa6f-0c6cc87df638

Financial Times. https://www.ft.com/content/fb2b6cea-26d7-4f25-ac7c-8395f66db784

U.S. Geological Survey, Mineral Commodity Summaries. https://pubs.usgs.gov/periodicals/mcs2021/mcs2021-rare-earths.pdf

Financial Times. https://www.ft.com/content/fc43a3c6-ce0f-11e9-99a4-b5ded7a7fe3f

Financial Times. https://www.ft.com/content/f418bb86-bdb2-11e9-89e2-41e555e96722

Chemical and Engineering News. https://cen.acs.org/articles/95/i34/whole-new-world-rare-earths.html

Financial Times. https://www.ft.com/content/b13a3c4e-e80b-4a5c-aa6f-0c6cc87df638

Yale Environment 360. https://e360.yale.edu/features/china-wrestles-with-the-toxic-aftermath-of-rare-earth-mining

Chemical and Engineering News. https://cen.acs.org/articles/95/i34/whole-new-world-rare-earths.html

We recently recorded a webinar titled 'Perspectives on Uranium Demand and Supply'. You can view it here. Please use passcode ?3gDUblB