This technological change is expected to lead to innovation, disruption of today’s ways of doing business, and revolutionise industries on a scale not seen since the development of the internet.

Elementum Metals: 24/03/2021

The anonymous person using the pseudonym Satoshi Nakamoto invented blockchain in 2008 as an enabling mechanism for Bitcoin.1 One of the challenges in developing systems that enable a store of value is that computers’ key design objective is speedy and accurate replication of activities and data; as a consequence, scarcity and uniqueness is difficult to achieve. However, in Blockchain, Satoshi Nakamoto designed a mechanism to enable unique transactions and records, together with the ability to control duplication of those same records.

Blockchain, is in essence, a shared database located in multiple sites across geographies and organisations. All participants control their own copy of the ledger, having digital keys and signatures that allow them to access and update their ledger in accordance with the rules of the systems, once verification protocols have been satisfied.

A Blockchain is a list of transactions, each one linked to the preceding transaction, using a labelling system that refers directly to the prior transaction. Blockchain algorithms enable transactions to be aggregated in ‘blocks’ by attaching a new transaction to the preceding transaction using a cryptographic signature. The security and data integrity of distributed ledgers is ensured through the existence of multiple versions of the same database in different locations; an unauthorised change to the database would have to involve simultaneous amendments to all databases – something exceptionally difficult to achieve, especially as the number of users grows.

A number of other distributed ledger systems were developed in the wake of Satoshi Nakamoto’s specification of blockchain. These include Direct Acyclic Graph (DAG) which seeks to overcome blockchain’s scalability and transactions per second constraints through independent data structures; Hashgraph, which uses ‘virtual voting’ ‘Gossip’ protocols to validate transactions through a consensus; and Holochain which seeks reduced data congestion by distributing data across a number of node locations.2

While traditional ledgers operate in a centralised manner with all information held in one location, Blockchain platforms operate by applying de-centralisation principles.

Permissionless public systems have no central owner controlling access to the network. Bitcoin is the best-known example, where anyone can add a block to the existing chain once they have solved a cryptographic puzzle, termed ‘mining’. Other examples include Ethereum, which provides a number of tools and services including de-centralised applications (dapps) and Monet, an open-source blockchain intended for ad hoc peer to peer collaboration.3 In permissionless systems, integrity is achieved through cryptographic and algorithmic solutions which ensure anonymous network participants are incentivised to enforce accuracy of the ledger without regulation and administrative control. Permissionless open networks tend to be the more powerful than closed networks; stakeholders have an interest in collectively agreeing to operating model standards, including sharing of benefits and costs, and how access is granted and risk managed.

Image from https://blockruption.com

In permissioned blockchain systems which often operate on a private basis, members are pre-selected with an administrator controlling access and enforcing rules. Central administration and regulation ensure permissioned systems’ superior identity and data privacy. Another attractive attribute of this model is it more readily fits in with existing legal and regulatory frameworks, so is more suited to replace traditional record-keeping and transactional systems. Hyper-ledger Fabric is an example of a permissioned system supporting private transactions and agreements that’s used by organisations such as Walmart, the government of British Columbia and Deutsche Börse.4

Initially, permissionless open networks were used primarily for crypto-assets held by the public, while enterprise-based systems were permissioned and operated privately. However since 2019 there’s been a trend away from centralised systems towards decentralised permissionless systems driven by cross industry collaboration and an increased willingness to experiment with public platforms.5

The best-known application for Blockchain is Bitcoin, the largest of the many digital currencies. However, there are many other applications, across all industries, such as transaction settlement in financial services, insurance claims management, copyright records in the media and healthcare patient records.

Applications commonly focus on reducing administrative costs and increasing efficiency such as in healthcare where there is significant potential for streamlining existing processes such as exchanging patients’ medical records across health providers, insurers and patients.

Businesses employing Blockchain for supply chain management tend to use private, permissioned systems that allow the sponsor’s management to control membership, access and rights. For example, Everledger has built a number of Blockchain based platforms supporting specialist businesses, one of which is a distributed ledger that records diamonds. A digital ‘passport’ is created for each diamond recording its provenance, movement, cutting work, exchange of ownership and other relevant information. The system is intended to provide benefits including reducing document forgery and fraud, facilitate effective insurance cover and provide information about the provenance of gems in order to prove their sustainability status. Actors in the diamond market use the system to avoid being part of the chain associated with money laundering, terrorist financing and conflict zone sourcing.6

In the metals industry, firms are using Blockchain to record supply chain transactions in metals such as tin, tungsten, tantalum and gold that are at risk of being sourced from mines associated with conflict or human rights abuse. For example, Sustain Block, supported by the European Partnership for Responsible Metals, established a scheme in 2019 tracking supply chains for metals from Rwanda. iPoint has developed a system tracking metals from mine to store to support consumer brands’ efforts to prove to customers their high sustainable and social responsibility standards,7 while Minespider is another system tracking metals from mines to smelters and onto factories.8

Trade and trade finance is another area that has seen considerable development. Marco Polo and Contour are examples of trade finance networks established to support banking transactions.9 TradeLens, a blockchain-based digital supply chain developed jointly by Maersk and IBM, seeks to reduce the complexities of tracking international trade through paper based systems.10 In 2018 HSBC and ING carried out the first trade finance transaction via blockchain for a shipment of soybeans from Argentina to Malaysia using a single shared platform to process tractions in 24 hours, compared to the 5 – 10 days normally taken by conventional methods.11

Companies spend significant time and resources reconciling their records with external sources in order to check their integrity and identify inconsistencies with partners’ records. Intra-organisation reconciliations are also common, as most companies use multiple systems for managing different processes, recording transactions and assets. Blockchain systems automate this expensive and error prone manual activity through ongoing automated verification processes that check accuracy and consistency of data across the network’s nodes.

Blockchain allows working practices to move away from traditional sequential communication and in turn processing by parties in a transaction chain, to allow simultaneous shared communication and activities enabled by network-based communication. One of the areas of application is security settlement; the Paxos Settlement Service which uses blockchain technology to settle US listed stock trades achieves efficiencies by combining asset registry and settlement registers, combining speed of processing and reduced need for cross ledger reconciliations.12

Benefits such as automation, transparency, enhanced auditability and programmability contribute to efficiencies and reduce costs, although implementation challenges exist in many industries as legal and regulatory frameworks for these new and evolving business models and relationships is yet to be fully established.

Digital tokens are records within a blockchain system that record ownership. Digital tokens can be natively digital, such as representing ownership of a cryptocurrency or digital bonds such as issued by the World Bank, or used to record ownership of a physical asset. Assets can be fungible, referring to non-unique assets such as soft commodities, or non-fungible which are unique such as works of art, allowing collectors to readily identify, track and trade rare and valuable items.

Sygnum Bank has taken advantage of Swiss federal law being adapted to accommodate distributed ledger technology to introduce platforms across Switzerland and Singapore that allow bank grade token issuance and digital asset trading. Under one part of this platform, they have issued the first tokenised range of investible wine in partnership with Fine Wine Capital.13

A smart contract is a piece of code stored in a Blockchain that automatically executes when pre-determined conditions are met. In cross business collaborations, smart contracts can be used where enterprises consent to be bound by agreements without the involvement of external intermediaries such as lawyers. The rules of smart contracts are pre-defined and outcomes clear, rapidly delivered and low cost to operate; this contrasts with traditional legal contracts which involve considerable manual interaction involved in interpretation, agreement between parties and enforcement.14

Smart contracts can be used for example to monitor, evidence and trigger payment for services performed under service contracts, automatically effecting payment once the required activities are performed. Smart contracts are particularly effective in achieving efficiency when integrated into financial systems with multiple routine transactions such as on financial exchanges.

While popular recognition of Blockchain is primarily associated with cryptocurrencies, its relevance in both public and private areas extend widely into collaborative networks, record keeping, transactions and exchanging value. Most industries recognise significant benefits leading to rapidly increasing adoption that’s beginning to fundamentally change the way businesses and private individuals interact with each other.

Distributed Ledger Technology and Blockchain, World Bank. http://documents1.worldbank.org/curated/en/177911513714062215/pdf/122140-WP-PUBLIC-Distributed-Ledger-Technology-and-Blockchain-Fintech-Notes.pdf

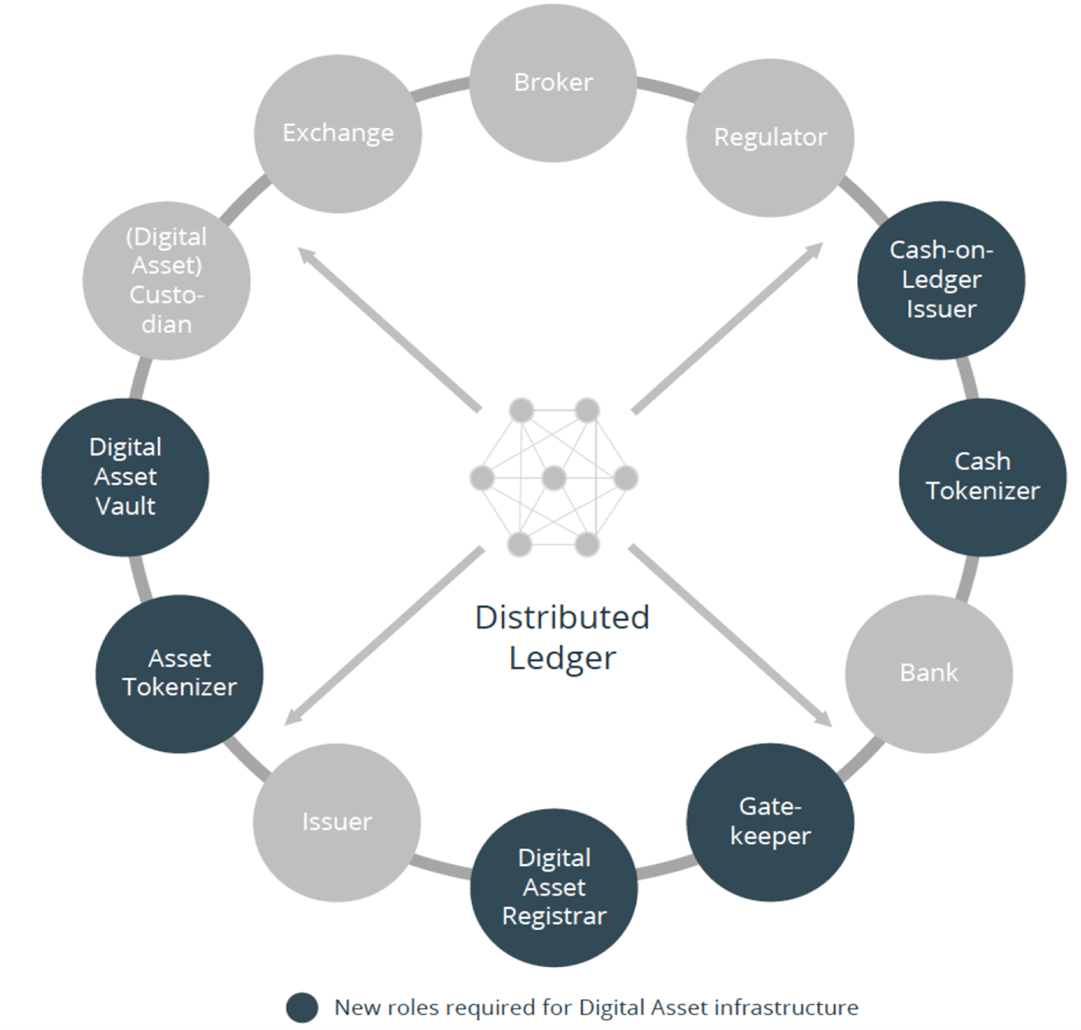

Blockchain and DLT – Transforming the Financial World, Tokentrust AG BrightTalk with NTree. https://www.brighttalk.com/webcast/17849/468189

Hyper real: An overview of global blockchain industry trends, Invesco. https://www.invesco.com/emea/en/invesco-insights/insights/hyper-real-an-overview-of-global-blockchain-industry-trends.html

Bloomberg, April 2019. https://www.bloomberg.com/news/articles/2019-04-24/using-blockchain-to-help-fight-conflict-minerals

https://www.marcopolo.finance/ , https://www.contour.network/

Rebooting a Digital Solution in Trade Finance, Bain and HSBC. https://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwil1-D52_3uAhVKQUEAHTwsAvAQFjAAegQIARAD&url=https%3A%2F%2Fwww.gbm.hsbc.com%2F-%2Fmedia%2Fgbm%2Finsights%2Fattachments%2Frebooting-digital-solution-digital.pdf&usg=AOvVaw12HyGoam1-Ut9MHho3Oy0W

Hyper real: An overview of global blockchain industry trends, Invesco. https://www.invesco.com/emea/en/invesco-insights/insights/hyper-real-an-overview-of-global-blockchain-industry-trends.html

Blockchain and contracts – a smart new world, Freshfields. https://www.freshfields.com/en-gb/our-thinking/campaigns/digital/fintech/blockchain-and-smart-contracts/