It is important to consider the difference between Distributed Ledger Technology (DLT) and Blockchain technology, which are sometimes used interchangeably but are nonetheless different.

Elementum Metals: 04/05/2021

Blockchain technology, on the other hand, is a specific form of DLT, providing a distributed ledger where data is structured in blocks and interconnected with one another. The difference between DLT and Blockchain is that the distributed ledger does not need to have its data structured in blocks; it is merely a digital database spread across multiple sites, regions, or participants. All Blockchains are forms of DLT, but not all DLTs are Blockchains.

Within the commodities sector, there are vast, and sometimes highly complex, supply chains developed from the producer or miner through to the consumer purchasing a finished product. Many economic agents are involved throughout these chains, adding value to the commodity at each stage; a process requiring invoicing, documentation, regulation, and freight. Historically, this has been done in a highly inefficient way, utilising accounting ledgers and manual entries in spreadsheets and databases. The downside to this legacy process is its higher potential risk associated with human error, auditing, regulations, settlement, and fraud. This industry, therefore, is very well suited to embracing Blockchain technology along its supply chain. Imagine all supply data can now exist across multiple locations and devices, with any changes to the data requiring validation by various nodes and simultaneously reflected in every copy.

Blockchain is already revolutionising the commodity industry as we know it, ranging from disrupting commodity trade finance, enhancing security across the entire sector, and even changing how we record and collate information across the supply chain, including capturing mining and refining ESG relevant information. This helps engender a higher degree of transparency, trust, efficiency, and control than has previously been the case in supply chains generally, and certainly within the commodities sector – one only needs to think of the Mercuria debacle, in which the Swiss trader bought $36m of copper only to have red-painted rocks delivered,1 to see why these measures might be needed.

As mentioned, a Blockchain is a chain of blocks, where the blocks are digital information stored in a public database (the chain). Each current and new block is linked together through a crypto signature called a “hash.” Once data is recorded onto the Blockchain, it becomes unalterable. A single block contains three components:

1) The data – The data stored depends on which type of Blockchain we are looking at (for Bitcoin, it includes details such as the sender, receiver, and amount)

2) The hash of the block – This is an alphanumeric string. Each transaction generates a hash which is effectively the digital fingerprint. If data in the block is changed, the hash of that block will change as well

3) The hash of the previous block – This creates the “chain,” making Blockchain secure

As all blocks are interconnected through hashing, if one block is tampered with, its corresponding hash will change, in turn causing the next block in the chain to become invalid. As a result, the previous block's hash will no longer match the hash in the next block. Through this mechanism, hashing prevents hacking of the Blockchain. Furthermore, consensus algorithms are in place where the network members will validate new blocks. The primary consensus mechanism used in the first and most popular Blockchain (Bitcoin) is known as Proof of Work (PoW); here, validators (miners) compete with one another to solve complex mathematical puzzles, with the “winner” receiving a reward (e.g., 6.25 BTC on the Bitcoin Blockchain). PoW slows down the creation of new blocks to 10 minutes and therefore prevents hacking as you will need to calculate the POW for every other block if you tamper with one. Lastly, Blockchain is a Peer-to-Peer (P2P) network where anyone can join. If a new block is created, that block is sent to everyone, and each node verifies it to ensure it has not been tampered. If 51% of the network approves it, the block will be added. The combination of these security features makes hacking Blockchain almost impossible to do in the real world.

Another critical property of Blockchain is its public immutable ledger attribute. Meaning that, once data is added through the creation of a new block, it cannot be altered or changed, and all data is open and accessible to view by any member of the network. Moreover, Blockchain is decentralized, and everyone who is a part of the system is responsible for its development and growth rather than a centralized company or government.

The last two significant aspects of Blockchain are Tokenization and Smart Contracts. Tokenization is the process of creating tokens that represent tangible and intangible assets. The property rights of the underlying asset can then be subsumed by the token and stored/traded on be put onto the Blockchain to be traded or stored without a central 3rd party. Holders can redeem their tokens for the underlying asset, where possible. These have featured in mainstream news recently, where non-fungible tokens (NFTs) have traded for large sums, as they represent ownership of a digital asset, be it an image or a tweet.

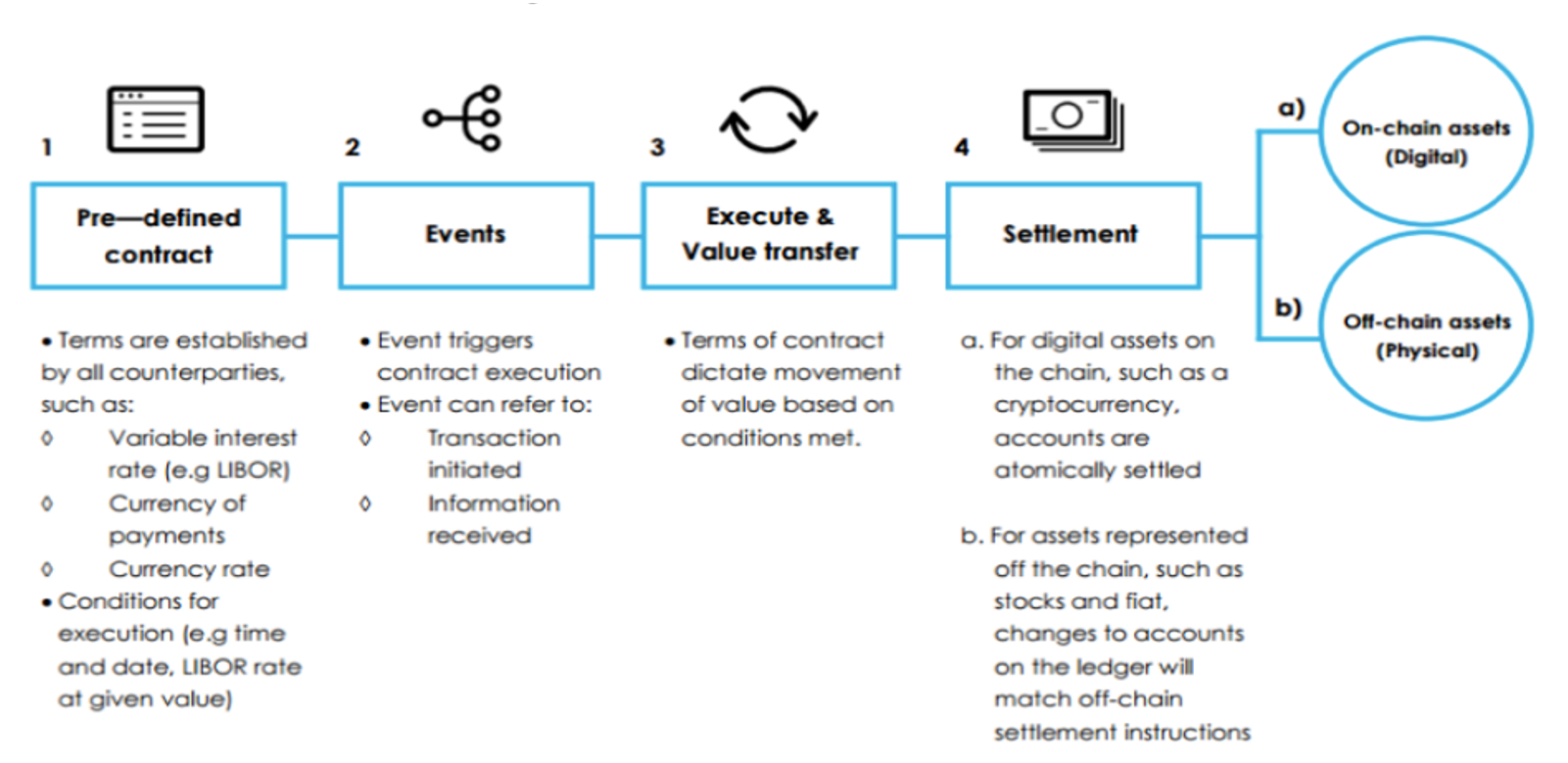

Lastly, Smart Contracts are self-executing contracts used to exchange crypto assets when certain pre-determined conditions coded into the contract are met, allowing for instantaneous transfer. They are traceable, transparent, and like information recorded onto the Blockchain, irreversible. The diagram below shows the different stages of a smart contract:2

With Blockchain’s decentralised technology, the problems associated with a single source of failure are eliminated. With Blockchain, the ledger will be distributed across numerous participants, locations, and devices; if one person loses a copy of the ledger, there will be a multitude of other records available. This is essential in a sector that deals with large quantities of contracts and documentation like the physical commodity trading business.

Blockchain’s security aspects are a critical driving force for its rising popularity in commodities. Fraudsters, money launderers, and sanctions busters tend to favour commodities for their illicit activities; UBS lost $60 million in October 2020 due to a commodity trade finance fraud case,3 and in 2018 with a Halkbank executive being prosecuted for his role in helping assist hundreds of millions of dollars of gold transactions in a money-laundering scheme.4 According to Global Financial Integrity, $950 billion in commodities have been exported out of Emerging Markets, of which 80% have involved some form of illegal practice. In theory, it is almost impossible to hack data in the Blockchain as you must tamper with every block in the chain (due to hashing), re-do the PoW of each block, and take control of 51% of the entire network. This, combined with the fact that it is an immutable public ledger and a Peer-to-Peer system, helps provide solutions to many of the governance challenges associated with commodities.

Tokenization is a ground-breaking development of Blockchain, allowing commodity details and ownership to be captured, traded, and stored in a digitally secure manner. Tokenization has the added benefit of facilitating fractional ownership of assets and improving liquidity. For example, there are numerous gold tokens available to purchase on crypto exchanges, where an accumulation of tokens represents an entire gold bar. A real-world example is PAXG, a gold-backed crypto token, with each token representing one fine troy ounce of gold. This Tokenization of gold allows investors the ability to invest in smaller fractions of a gold bar, with minuscule fractions divisible by 18 decimal points of 1 token allowable with PAXG.5 Tokenization enables a broader range of investors to access the market as there will be no geographical limitations, along with lower minimum capital requirements (you only need access to a device that can connect to the network and enough resources to buy the asset).

Tokenization allows for trading commodities to occur with no time constraints, 24 hours a day. Of course, this isn’t a limitation in the Over The Counter (OTC) market, but trading of commodities on traditional exchanges will have a close of business day. In the future, the removal of all middlemen (such as conventional exchanges) may even occur, whereby it is as simple as one party sending over a commodity-backed token to another instantaneously and safely, eliminating any extra fees charged by the exchange. Tokenization confers all the benefits of owning a tangible asset with the speed and mobility of a digital one.

Intelligent Contracts can eliminate counter-party risk allowing simultaneous and instantaneous transfer of crypto assets once the pre-existing conditions are met. Smart Contracts are also immutable, and the output is validated by all participants on the network, meaning the contract cannot be forced open to release the assets. Lastly, automation using these contracts can prevent human error, increase accuracy, and minimize costs.

Smart Contracts and Blockchain are already being utilised in the commodity sector; in 2019, HSBC executed a Letter of Credit from HSBC Malaysia to HSBC Singapore on behalf of behalf of packaging firm, Simply Packaging, via Blockchain.6 In the HSBC example, the seller received a payment confirmation that was accomplished via a smart contract once the pre-determined conditions were met. On the physical goods side, the assets were tagged with QR codes linked to the smart contract.7

Blockchain may be a “quick win” for the OTC market, with the exchange of trade confirmations directly between two parties taking place without middlemen. The OTC market requires fewer clearing requirements, lack of resistance from clearinghouses, and smaller market size favouring smart contracts adoption.

The three main different types of Blockchains are Public, Private, and Hybrid:

Public Blockchains are permissionless. They are open to writing and reading. Anyone can join the network, and it is decentralised, e.g., Bitcoin and Ethereum.

Private Blockchains are permissioned, meaning restrictions are in place on who can join and in which transactions, e.g., Hyperledger Fabric Blockchain.

Hybrid Blockchains are a combination of the best parts of a public and private Blockchain.

Private and Hybrid are the most relevant Blockchains for the commodity industry. Parties to a deal can trade and exchange payment details directly, and any 3rd parties like warehouses or freight carriers will not automatically have access to all the deal information. Whereas with a public blockchain, all the participants in the network are continuously updated by any changes in the whole supply chain.

The commodities industry has been able to use Blockchain technology to leverage two key concepts: Provenance and Single Source of Truth. Provenance projects allow for numerous pieces of information to be collected and accessed about the commodity through its supply chain and lifecycle, including place of origin, smelting and delivery dates, refiners, authentication documents, serial numbers, etc.

SSOT is the practice of collecting all relevant data in a single location which allows all parties in a commodity transaction to have access to the same data from a single source. SSOT’s provide authentic, relevant, and referable data, which is an attractive feature for governance and oversight functions.

With Provenance and SSOT projects, ESG targets can be met, through measures such as observing if your commodity was mined and refined from an ethical source, along with all the relevant audit and freight documentation attached and encrypted onto the Blockchain. Additionally, pollution could be tracked, as the provenance feature can allow environmental data to be captured throughout the supply chain.

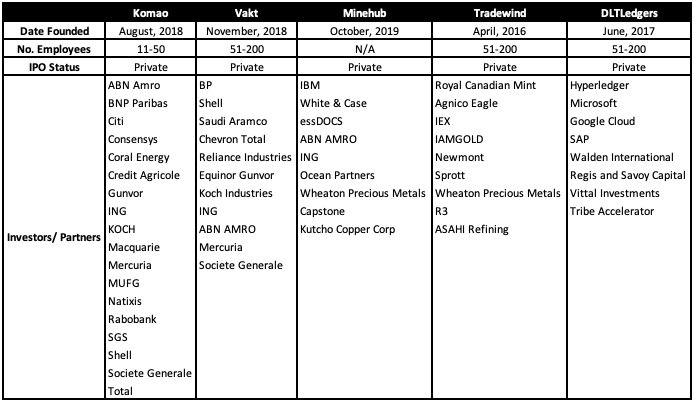

Five firms disrupting the commodities industry using Blockchain are Komgo, Vakt, DLTledgers, Minehub, and Tradewind. The appendix provides some descriptive statistics on these companies.

Despite the Commodity Trade Finance (CTF) industry recently suffering from significant setbacks, including an oil price crash, trade wars, and major fraud cases in Singapore, Blockchain initiatives in the industry are booming. Three of the major players in the industry (Komgo, Vakt, and DLTledgers) have confirmed positive growth throughout 2020 (GTR). The CEO of Komgo, Solueima Baddi, stated LC transactions “almost doubled.” At the same time, DLTledgers claimed the platform increased by 50%, and Vakt’s CEO, Stephanie Trabia, claiming they have gained more “traction” as well.8

Given the increasing concerns over fraud and security concerns over remote working, agents are increasingly turning towards Blockchain, for its enhanced security features. Examples of significant fraud in 2020 have been witnessed in Singapore, including Agritrade being accused of passive deception by ING court filings and one of Asia’s largest independent trading houses, Hine Leong, collapsing.

Komgo’s primary goal is to digitise and streamline CTF using the Hyperledger Fabric Blockchain. Its platform provides a SSOT and provenance to its customers through four separate Blockchain-based products.

Konsole: This allows corporate clients and banks to connect and manage their opening, amendment, presentation, and settlement of documents all under one simple platform. A wide range is covered, including LCs, SBLCs, documentary collections, and the release of goods and guarantees

Market: This product was created to optimize liquidity and risk, allowing clients to manage risk cover, confirmation, discounting, and treasury activities with multiple banks and allows users to send requests or publish pricing data on a transparent, aggregated platform

Check: Acts as a “digital relationship manager” by bringing all KYC exchanges and documentation into one system, reducing manual touchpoints, and automating critical steps in the onboarding and renewal process

Trakk: Acts as a provenance service managing risk by allowing users to stamp, trace and authenticate digital documents across the supply chain

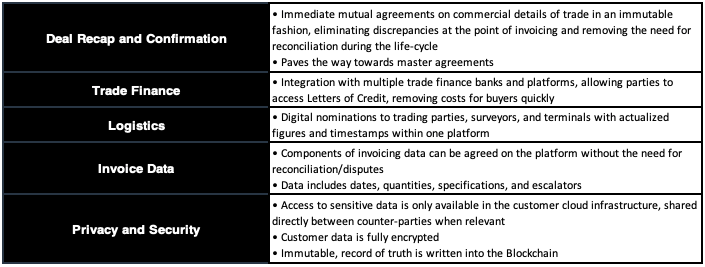

Vakt is a Blockchain consortium that purely focuses on oil post-trade settlement. It can be considered as an SSOT, with its primary goal being to increase efficiency by bringing together all stakeholders into a single system that is well designed and tamper-proof. Vakt’s platform, based on the Quorum Blockchain, allows for CTF (allowing integration with multiple trade finance banks and platforms), invoice data, logistics, confirmation, and security from trade entry until the final settlement of the commodity. The table below provides a detailed analysis of each of these features:

Vakt is the sister company to Komgo as they both share a majority of shareholders. Furthermore, the Vakt and Komgo platforms are connected, as banks on Komgo can offer Blockchain-based financing to Vakt users.

Currently, Vakt is focused on the oil sector, with approximately half of its participants engaged in BFOET oil trade, but they have plans to expand into the gas and power industries in the future.

The Singapore-based DLTledgers, launched in early 2018, also acts purely as an SSOT. Using the Corda Blockchain, the platform lets companies keep track of their CTF documents and allows parties to send encrypted messages to one another, all within one simple platform. Firms can track and manage their contracts, documents, goods, and payments in real-time.

Furthermore, trade finance providers can offer instantaneous financing support, which allows for LC transactions and supply chain financing. There are approximately 400 commodity traders, 20 plus large corporates and 45 banks signed up. More than $3 billion in trade finance has been processed on the platform.

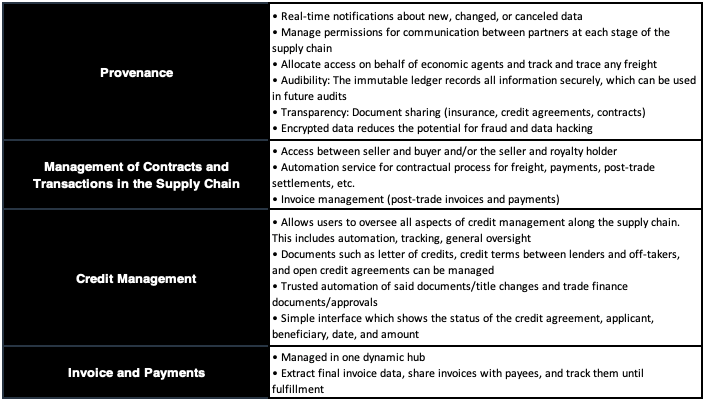

The Minehub platform uses the IBM Blockchain platform to deliver a SSOT and provenance service to its clients. The company’s primary goal is to achieve transformative efficiency through a paperless mining and commodities supply chain. Minehub creates a real-time flow of information and products along the entire supply chain, from mine to market, in a straightforward platform. Its main features are:

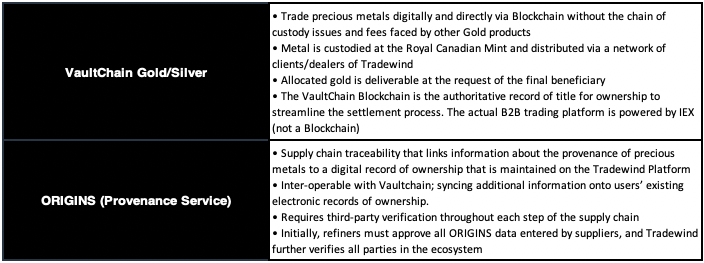

By leveraging Blockchain, Tradewind facilitates trading, supply chain management, settlement, and custody of precious metals. Therefore, providing a SSOT and provenanceservice. Tradewind selected to build a private Blockchain application using R3’s Corda platform on Amazon Web Services (AWS). Tradewind offers two main products, VaultChain Gold/Silver and ORIGINS.

Global Palladium Fund, owned by Nornickel (the world’s largest producer of palladium and one of the largest producers of nickel, platinum, and copper), have created a new generation of physically backed Exchange Traded Commodities (ETCs), giving exposure to physical spot Gold, Silver, Platinum, Palladium with Copper and Nickel due to be launched next month. This will be the first time Blockchain technology is integrated with an ETC. The custodian uses the technology to record the metal bars backing the ETC to enhance the information held on the published bar lists. Most excitingly, by combining Blockchain technology with ETCs, GPF will enable supply chain ESG data to be captured. Moreover, this is the first time a copper and nickel ETC with exposure to spot performance will be available to investors.

Blockchain and its key features of enhanced security, decentralization, transparency through an open ledger, immutability, tokenization, and smart contracts, are becoming hard to ignore in many industries, including the commodities sector. The use of the technology has led to many successful provenance and SSOT projects, and its adoption as part of an ESG monitoring framework offers an exciting opportunity to shape the zero-carbon economy. Blockchain has the potential to turn the whole industry paperless, reducing errors, increase mobility, reduce capital constraints and costs associated with intermediaries. Someday we may see a system where a vast number of commodities can be traded instantaneously between parties purely on the Blockchain.

- Written by Jay Kumar

Hoffman, Andy; 9/3/2021: Trader Buys $36 Million of Copper and Gets Painted Rocks Instead. Bloomberg: https://www.bloomberg.com/news/articles/2021-03-09/trader-buys-36-million-of-copper-and-gets-painted-rocks-instead, last accessed 30/4/21.

Ship & Bunker; 22/10/20: UBS Loses $60 Million in Commodity Trade Finance Case. Ship & Bunker: https://shipandbunker.com/news/emea/494543-ubs-loses-60-million-in-commodity-trade-finance-fraud-case, last accessed 30/4/21

https://www.riskscreen.com/kyc360/article/precious-metals-the-gold-standard-in-money-laundering

Paxos Global, https://www.paxos.com/paxgold, Accessed 29/4/20

https://cointelegraph.com/news/hsbc-enacts-a-letter-of-credit-on-a-blockchain-in-malaysia

https://www.pwc.com/gx/en/industries/assets/blockchain-technology-in-energy.pdf

https://www.gtreview.com/magazine/volume-19-issue-1/commodity-blockchain-platforms-booming-business